The ECB yesterday left policy unchanged as expected, with Draghi saying decisions on QE will probably be taken in October. The chairman also commented that the rise in the euro means financial conditions have tightened.

In the US, expectations of a December rate rise have dropped considerably. Fed vice chairman, and noted hawk, Fischer resigned this week, and will leave his post next month. This adds to uncertainty about the Fed leadership, with Yellen’s term as chair due to expire early next year.

Tensions with North Korea, and the hurricane hitting Florida, are also weighing on the dollar.

For the UK, the economic data continues to remain soft.

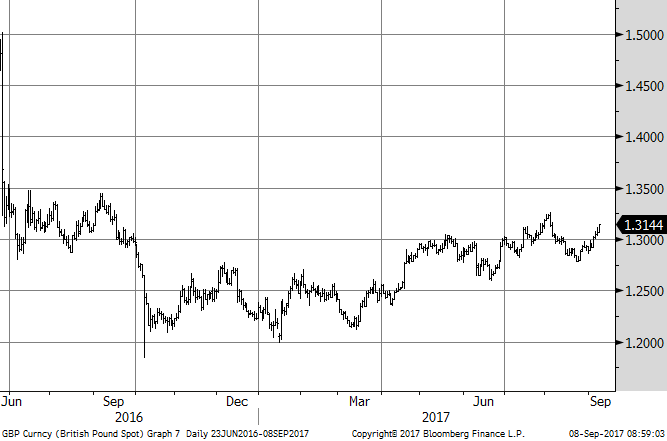

On the exchanges, GBP/USD has broken above the 1.3000 level on general dollar weakness. The high last month around 1.3250 should hold the topside, whilst 1.2950 provides initial support from here.

GBP/EUR has found some support following the new year-to-date low of 1.0740 last week, although Euro sentiment remains strong. We need a closing break of 1.1000 to alleviate the risk of further short-term weakness.

Week ahead

| Date | Release | Last | Expected* |

| 12/9/17 | UK CPI YoY | 2.6% | 2.7% |

| 14/9/17 | UK BOE Base Rate | 0.25% | 0.25% |

| 14/9/17 | US CPI YoY | 1.7% | 1.8% |

*Bloomberg survey

Equity Indices

| Indices | Previous Close | YTD % Change |

| FTSE 100 | 7396 | +3.29% |

| S&P | 2465 | +10.11% |

| EUROSTOXX | 3447 | +4.60% |

| DFM GENERAL INDEX | 3644 | +3.22% |

Foreign Exchange

| Currency | Last | Currency | Last |

| EUR/USD | 1.2050 | AUD/USD | 0.8095 |

| GBP/USD | 1.3150 | USD/AED | 3.6730 |

| GBP/EUR | 1.0910 | GBP/AED | 4.8280 |

| USD/CHF | 0.9475 | EUR/AED | 4.4260 |

| USD/JPY | 107.75 | XAU/USD | 1353 |

UK Benchmark Rates

| Libor | Swap Mid | ||

| 3 month | 0.28575% | 2 year | 0.54% |

| 6 month | 0.39763% | 3 year | 0.61% |

| 12 month | 0.58838% | 5 year | 0.74% |

Click here to view National Treasury Bank’s deposit rates.

The information given in this document is for information purposes only and is not a solicitation, or an offer to buy or sell any security or any other investment or banking product. It does not constitute investment, legal, accounting or tax advice, or a representation that any investment or service is suitable or appropriate to your individual circumstances. You should seek professional advice before making any investment decision.

The value of investments and the income from them can fall as well as rise. An investor may not get back the amount of money invested. Past performance is not a guide to future performance. Fluctuations in exchange rates may affect the value and any returns from investments.

The facts and opinions expressed are those of the author of the document, as of the date of writing and are liable to change without notice. We do not make any representations as to the accuracy or completeness of the material and do not accept liability for any loss arising from the use hereof. We are under no obligation to ensure that updates to the document are brought to the attention of any recipient of this material.

Please note that this commentary may not be reproduced, distributed, disseminated, broadcasted, sold, published or circulated without prior consent from National Treasury Bank.