Market focus this week has been very much on yesterday’s Bank of England meeting, with the vote for no change in policy coming in at 7-2. The committee reiterated the market is underpricing future interest rate rises, and indicated that a rate increase may be needed in the coming months. The market is pricing in a 50% probability of a November hike, and has fully priced in a 25bps increase.

The UK economy remains mixed, with inflation coming in above consensus at 2.9%, a 5 year high, whilst wage increases remain disappointing at 2.1%, despite employment remaining strong.

In the US, dollar sentiment remains weak as the inflationary outlook continues to soften, with the market no longer expecting another rate increase this year.

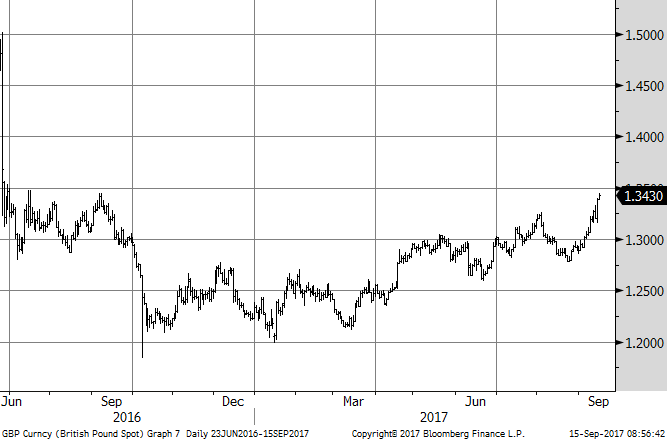

On the exchanges, GBP/USD is trading at a new yearly high, above 1.3400, following the BoE meeting yesterday. We have not closed above 1.3500 since Brexit and this will obviously be a key resistance.

Positive sterling momentum has pushed GBP/EUR above 1.1250. We expect 1.1400 to be a significant topside barrier, whilst 1.1000 should now be solid support.

Week ahead

| Date | Release | Last | Expected* |

| 18/9/17 | EU CPI YoY | 1.3% | 1.5% |

| 20/9/17 | UK Retail Sales YoY | 1.3% | 1.2% |

| 20/9/17 | US FOMC Fed Funds | 1.25% | 1.25% |

*Bloomberg survey

Equity Indices

| Indices | Previous Close | YTD % Change |

| FTSE 100 | 7295 | +1.80% |

| S&P | 2495 | +11.47% |

| EUROSTOXX | 3526 | +7.10% |

| DFM GENERAL INDEX | 3657 | +3.56% |

Foreign Exchange

| Currency | Last | Currency | Last |

| EUR/USD | 1.1915 | AUD/USD | 0.7995 |

| GBP/USD | 1.3430 | USD/AED | 3.6730 |

| GBP/EUR | 1.1270 | GBP/AED | 4.9330 |

| USD/CHF | 0.9625 | EUR/AED | 4.3760 |

| USD/JPY | 110.70 | XAU/USD | 1327 |

UK Benchmark Rates

| Libor | Swap Mid | ||

| 3 month | 0.30150% | 2 year | 0.72% |

| 6 month | 0.43143% | 3 year | 0.83% |

| 12 month | 0.63869% | 5 year | 0.99% |

The information given in this document is for information purposes only and is not a solicitation, or an offer to buy or sell any security or any other investment or banking product. It does not constitute investment, legal, accounting or tax advice, or a representation that any investment or service is suitable or appropriate to your individual circumstances. You should seek professional advice before making any investment decision.

The value of investments and the income from them can fall as well as rise. An investor may not get back the amount of money invested. Past performance is not a guide to future performance. Fluctuations in exchange rates may affect the value and any returns from investments.

The facts and opinions expressed are those of the author of the document, as of the date of writing and are liable to change without notice. We do not make any representations as to the accuracy or completeness of the material and do not accept liability for any loss arising from the use hereof. We are under no obligation to ensure that updates to the document are brought to the attention of any recipient of this material.

Please note that this commentary may not be reproduced, distributed, disseminated, broadcasted, sold, published or circulated without prior consent from National Treasury Bank.